Strategies to pass CPA Core 1 / CPA Core 2 online exam fall 2020/2021 Canada

It is again students will face online exam to write in fall 2020. Because of Covaid 19, CPA had changed the format for writing online exam to 2 case analysis instead of 75 % MCQ and one case analysis. It was observed that many students are struggling to write case analysis in the exam and could not get the success. I observed that many students lack confidence for passing these exams. They remain busy with job, family and for submission of assignments. They also lack technical knowledge of various course area covered. Strong Technical knowledge is the key to success in these exams.

I provide following highly successful strategy to pass these exams:

- Right from today, review your technical stuff of related course area along with your assignment work. Financial Accounting and Management Accounting are the two major courses in both Core 1 and Core 2, respectively. Allot more time on it. Learn the correct format of writing case analysis. Ensure that you read, understand, and prepare the outline for case in 30% of allotted time in each case. I have seen students normally are taking more time in the same and then lack confidence in writing the case effectively. Do the practices till you cannot achieve this.

- Daily try to read technical, solve some MCQ to understand the concepts clearly. If not, look into some example to go in more depth.

- Those who could not get success should consult experiences tutors for guidance and training. Repeated failure will increase frustration and you have only 3 attempts to get through. Those who have challenge exam, can also approach experienced tutor for guidance and training.

- Failure in either MCQ or Case analysis is mainly due to lack of technical knowledge and lack of practice and techniques to solve the MCQ and or understanding and analysis of major issues in the case.

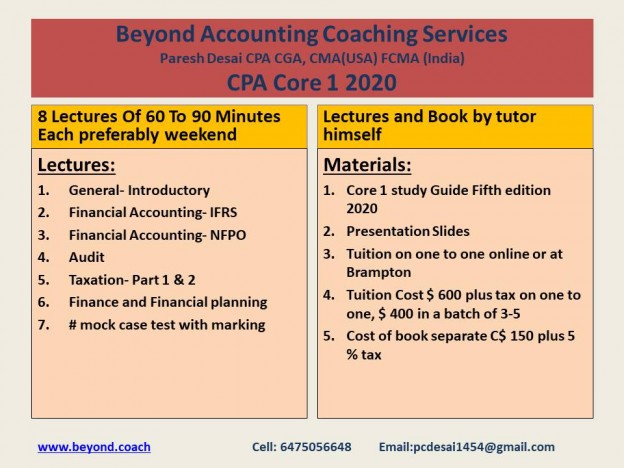

Students, who lack confidence in passing the course area, repeat writers, can take my lectures online. Exclusive book is available for Core 1 & Core 2 at a cost of $ 150 plus 5 % tax for Core1 and $140 for Core 2 (delivery free). Book contains all related technical concepts, enough selected MCQ and three cases analysis with solution. For repeat writers, one to one tuition is recommended.

For any further question visit my web site www.beyond.coach or send email at tutor.pa1.pa2@gmail.com